Table of Content

Credit errors might damage your credit scores in an unfair way. As a result, you want to make sure the information in all three of your credit reports is 100% accurate. Any credit score damage from payment delinquencies should fade over time. As you consistently pay on time moving forward, your credit score should improve in increments until those old late payments finally age off your credit report.

Let family and friends know you're looking for an owner-financed home. The more people who know, the more likely someone is to offer a lead. If you have a less-than-perfect score and are in the market for a house, here are some steps you can take. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying.

Credit Score Needed to Buy a House By Mortgage Type

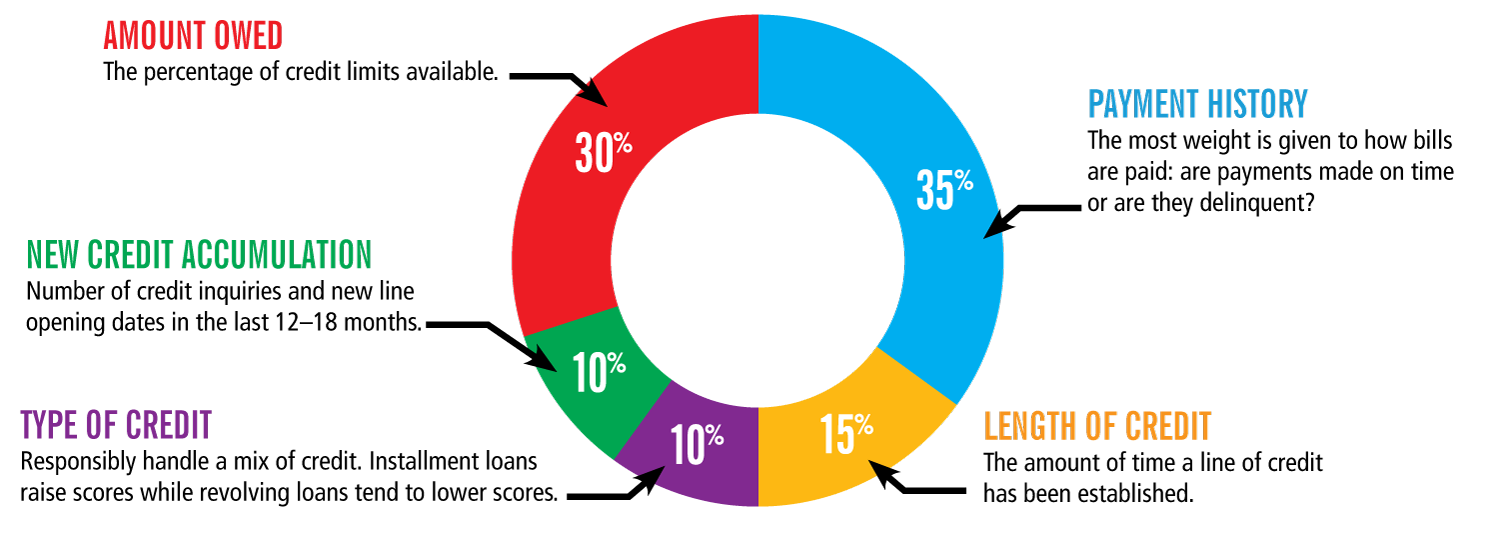

If you’ve never reviewed a credit report, it can feel overwhelming. There are public resources that can help you, or you can ask for help in our chat. We’ll consider the factors that impact your credit score and discuss ways to make improvements, like opening a secured credit card account or shifting balances between charge cards. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. Down payment, the more likely it is that you’ll qualify for a mortgage with a lower interest rate. That’s because lenders think you’re less likely to stop making your payments if you’ve already invested a significant amount of your money into your loan.

Though higher credit scores are considered more favorable for lenders, it’s still possible to get a mortgage with less-than-ideal credit. Conventional and government-backed loans have different credit score requirements. Valid bank account and Social Security Number are required. All loans are subject to ID verification and consumer report review and approval. Improvement in your credit score is dependent on your specific situation and financial behavior. This product will not remove negative credit history from your credit report.

Minimum Credit Score Needed to Buy a House by Loan Type

You’ll need a score above 500 to get approved for an FHA loan with 10% down. If you only have a 3.5% down payment, your score should be 580 or higher. This is also the minimum score recommended when applying for a VA loan. So, what can you do if you want to buy a house but have a poor credit score?

Larger down payments make it easier for you to win approval as you will be less of a risk. Lenders believe that putting more of your own money into the home will encourage you to work harder to keep up with the payments. There are three main credit bureaus, including Experian, Equifax, and Transunion. They will often have different scores, so the lender might take the middle one. Learning about your credit score gives you the power to improve it, and eventually qualify for your dream home. Your lender wants to be sure that you maintain steady employment.

Scores between 726 to 832

This is the ratio between the loan amount the lender will provide to the property's value. An LTV of 80 percent or less is ideal and makes you a less risky borrower. A high LTV ratio means the lender may charge higher interest on the loan.

The amount of money you have coming in each month is essential. Lenders will look at your gross monthly income, along with your expenses. A lending institution will want to know if there is a big difference between your gross and net income. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

Pay down credit cards

Often referred to as your Fannie Mae and Freddie Mac loan, a conventional loan is the exact opposite of a government-backed mortgage. If you have bad credit and fear you’ll face a loan denial when applying for a mortgage, don’t worry. You may still be able to get a mortgage with a low credit score. Of course it will depend on a few factors, so your best bet to see if you’ll qualify for a loan is to talk to a lender. Many lenders will have a conversation with you about your eligibility with no obligation to apply for a loan.

Co-signers don’t have to live with you, but they will share ownership of the home. If you can’t qualify on your own, then this is worth exploring. Lenders know that life is unexpected and bad things happen. What’s important is what’s happened in the time since the derogatory event occurred. Each post is edited and fact-checked by industry experts to ensure that we are providing accurate information for our readers. The Quicken Loans blog is here to bring you all you need to know about buying, selling and making the most of your home.

There are a few steps you can take, including improving your credit score. That takes time but it may be the optimal path, depending on just how low your score is. If you don’t want your own credit card, is there someone you trust who’d be willing to take you on as an authorized user? As an authorized user, you won’t even have to charge your friend’s credit card expenses.

You’ll get your results in writing, no matter the outcome. Hopefully, this will help your credit overall—and you’ll be ready to embark on your home buying journey. When you use credit cards, pay them off in full at the end of the pay period. You avoid paying interest and it shows lenders you have the cash on hand to pay for what you borrow.

Instead, these loans follow standards set by government-sponsored mortgage loan companies, Fannie Mae and Freddie Mac. Conventional loans may be secured by one of these companies or a private lender. These loans are more affordable and require a minimum 620 credit score. Here are the minimum credit score requirements for several mortgage loans, using estimates from FICO. Low credit scores create risk for mortgage lenders, and large down payments take the risk away.

Jumbo loan is similar to a conventional mortgage except that the loan amount exceeds the conforming limits set by the Federal Housing Finance Agency . In preparation for 2023, the FHFA set the conforming loan limit to $715,000. If you live in a high-cost area, such as Hawaii or Alaska, the limit is $1,073,000. Qualifying for a mortgage because it shows the lender you’re likely to repay your loan on time. A high credit score will smooth the way to a successful home loan application. Your credit score is a big number above your head that tells a potential lender how much of a risk you are.

No comments:

Post a Comment