Table of Content

If you're approved for a conventional mortgage with a fair credit score, you may end up with a higher interest rate than is currently advertised. Of course, maybe you just haven’t borrowed much money, or you don’t have a portfolio of different types of credit. That can result in a low score even though you haven’t been irresponsible with credit cards. But to lenders, that’s a risk to them because they don’t have evidence for well-managed borrowing behavior. And the riskier the borrower, the more lenders will try to minimize the risk to themselves with a higher interest rate and other possible terms that are costlier to the borrower. Credit scores determine the risk you bring as a borrower when you take out a loan.

The table below summarizes generational differences among Credit Karma members with mortgages. This might indicate a general decline of credit health across all consumers over the last two years. Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

See What You Qualify For

However, the credit bureaus have allowed a free weekly check of your credit score through 2022 due to the Covid-19 pandemic. It’s not enough to improve your credit to qualify for more mortgage loans. These other factors will also help you improve your mortgage terms to negotiate better with your lender. Having a higher credit score makes a big difference in the amount of money you pay over the course of a loan. Borrowers with scores in the higher range can save thousands of dollars in interest payments over the life of a mortgage.

A bad credit score could mean you don’t get to borrow as much as you’d like. This means you might have to adjust your expectations and settle for buying a home that costs a little less in order to qualify for the loan. With no money down, you’ll have higher monthly payments, potentially a higher interest rate and less chance of approval compared to someone who provides more cash up front. VA loans and USDA loans both offer financing for low- or no-down payment loans.

Business payments

There is a $40 fee, which is added to the monthly payment. The higher your credit score, the more likely you are to both qualify for a mortgage and for one at a lower interest rate. These are the pertinent questions you have to start asking yourself once you decide that it’s finally time to get that dream home. Let’s face it, house prices keep on going up, and if you pay in cash, who knows when you might come up short in the next emergency? So it’s just more reasonable at this time to get a mortgage so you can keep your money safe with you if you ever need it.

Other factors include loan amount, down payment, and location of the home. The credit score requirements differ based on how much money you plan to put down. Borrowers with higher credit scores can qualify to make a lower down payment. A jumbo loan is a kind of non-conforming loan that exceeds the loan limits established in the Fannie Mae and Freddie Mac lending guidelines.

What’s the minimum credit score I need to buy a house?

Americans hold around four credit cards on average, according to Experian. If you wish to use this type of loan, you must agree the house you’re buying will be your primary residence. Furthermore, the property has to be located within an eligible rural or suburban area.

Otherwise, when someone pulls your credit, and oftentimes this is you, to look at the general situation, this is merely a soft inquiry, and it doesn’t affect your credit at all. Some people are scared of checking their credit because of the fear of where it might be and because they think that doing so will do more harm. First of all, this is a misconception because there is a big difference between hard inquiries and soft inquiries. Finally, the USDA loan option is just in case you are purchasing real estate in a qualified rural area as defined by the U.S. If some styles in fashion can be expected to never go out of style, there is also a type of loan that you can expect to stay in demand for more years or decades to come. The less credit used compared to what’s available, the higher your score.

You can request your free credit score annually from a credit bureau, or by using ooba Home Loans’ Bond Indicator tool. Other assets you own, such as investments, property, cash savings, and retirement accounts, are also considered. Lenders want to ensure that you have an alternate source to make payments in case you lose your primary source of income. A low credit score can mean a significantly higher interest rate, costing you tens of thousands of dollars over the life of the loan.

Low credit utilization rates are best from a credit scoring perspective. So, if you’re looking for an actionable way to give your credit score a quick boost, paying down your credit card balances could be wise. Because conventional loans do not have the backing of the government, they can be riskier for mortgage lenders.

However, most lenders will require borrowers to have a 640 or greater credit score. However, the minimum credit score requirements vary based on the type of loan you take out and who insures the loan. Of our list below, conventional and jumbo loans aren't insured by the government and often have higher credit score requirements compared to government-backed loans, like VA loans. Looking at it from a lender’s perspective, where you land on the credit-scoring scale says a lot about how good you’ll be at repaying a home loan. That’s why lenders set minimum credit scores for a mortgage, and there aren’t many exceptions. Since jumbo mortgages allow such a high loan amount, lenders can be stricter about their minimum credit score requirements.

Let’s dive in and look at the credit score you’ll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit. If you do have a lot of responsibilities, are you able to pay your bills on time? It is of paramount significance that you don’t make any late payments before applying for a mortgage. When we say late payments, these are only considered late if they were paid 30 days after the deadline.

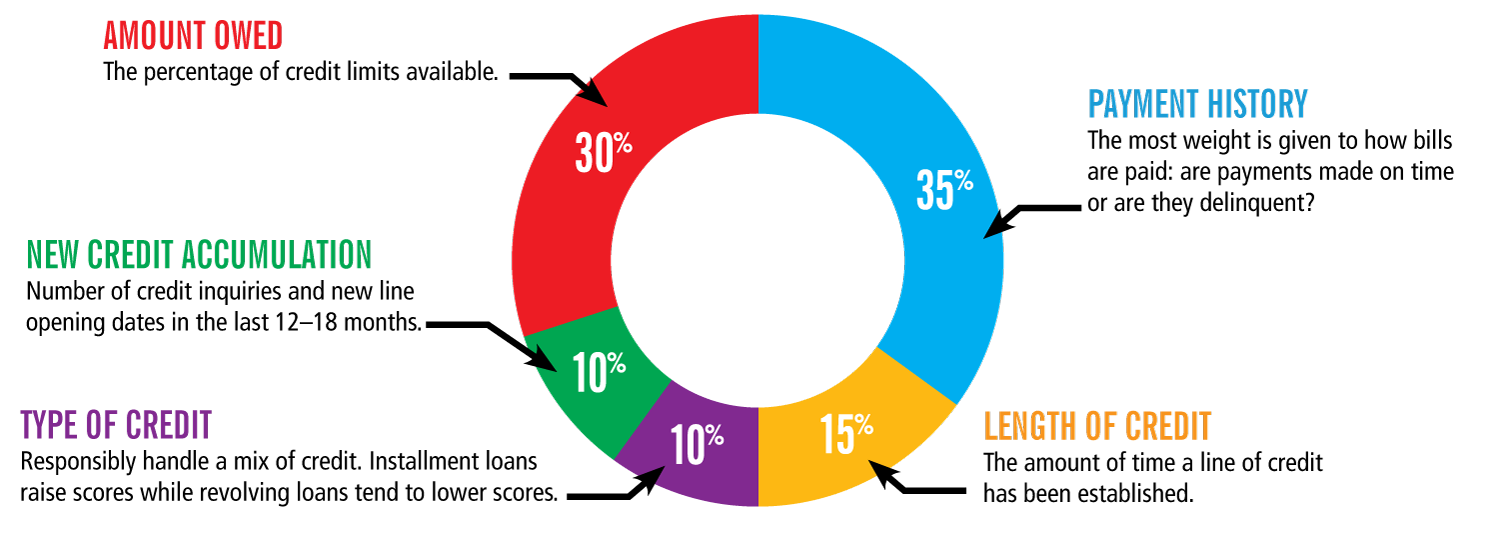

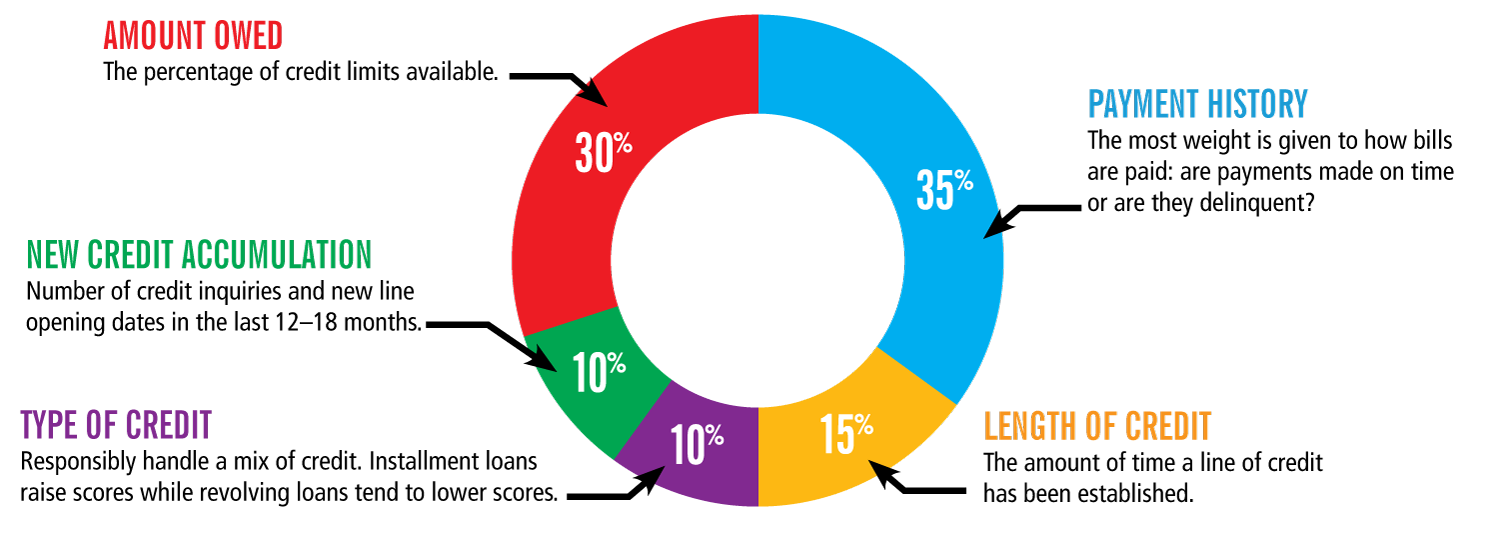

The Fair Credit Reporting Act entitles you to a free report from each credit bureau once every 12 months. The official site to request these free reports isAnnualCreditReport.com. Credit scoring models, like FICO and VantageScore, evaluate your credit utilization ratio when calculating your credit score. Credit utilization is a major component that contributes toward 30% of your FICO® Score.

No comments:

Post a Comment